Hey everyone, and welcome back to the Smart Study Blog! Today, we’re diving into something incredibly useful for every homeowner or aspiring buyer: understanding your tax liability on “Income from House Property.” We’re excited to introduce you to a fantastic, free online tool that makes this process simple and clear!

Why You Need This “Income from House Property Calculator”

Navigating tax regimes can be complex, but our calculator simplifies it. This powerful tool allows you to:

- Compare Tax Regimes: Easily switch between the Old vs. New Tax Regimes.

- Plan for Current & Future Financial Years: Analyze your tax situation for both Financial Year 2024-25 and the upcoming 2025-26.

- Understand Implications: See how different choices impact your tax outcome with real-time guidance.

This calculator is designed to help you make informed financial decisions and plan your finances better!

How to Access Your Free Tax Calculator

Accessing this powerful tool is super easy!

- Google Search: Go to Google and type “smart study blog” (without any spaces).

- Select the Link: Click on the first link, smartstudyblog.com.

- Navigate to the Tool:

- Mobile Users: Look for the menu icon (three dashes) in the top-left corner, select it, then choose “Tool” from the menu bar.

- Desktop Users: You’ll find the “Tool” menu directly on the home page.

- Find the Calculator: Under “Tax and GST India,” you’ll find this amazing calculator.

Pro Tip: The direct link to this calculator is also provided in the description below this video/post for your convenience! You can find the tool here: https://smartstudyblog.com/income-from-house-property/ and watch the video here: https://youtu.be/fNkfqAYBgsI.

A Walkthrough of the Calculator’s Features

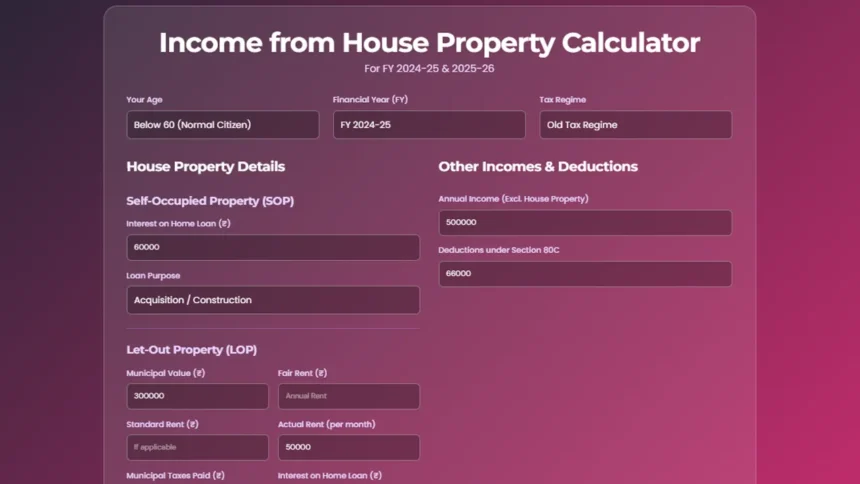

Once you open the calculator, you’ll find a clean and user-friendly interface. Let’s go through it section by section:

1. Basic Details

- Age Category: Select “Below 60 (Normal Citizen)”, “60 to 79 (Senior Citizen)”, or “80 and above (Super Senior Citizen)”. This is crucial as tax rules vary by age under the Old Tax Regime.

- Financial Year: Choose between FY 2025-26 or FY 2024-25.

- Tax Regime: Select “New Tax Regime” or “Old Tax Regime.” As you switch, the ‘Guidance and Information’ section will update with key insights specific to each regime.

- Example: In the New Regime (FY 2025-26), income up to ₹12 Lakhs can be effectively tax-free due to Section 87A rebate, but common deductions like Section 80C or home loan interest for self-occupied property are not available. The Old Regime offers these deductions but has different tax slabs.

2. House Property Details

The calculator handles two main scenarios:

- Self-Occupied Property:

- Enter “Interest on Home Loan” and “Loan Purpose” (Acquisition/Construction or Repairs/Reconstruction).

- Remember: Under the Old Regime, there’s a limit (generally up to ₹2 Lakhs for acquisition/construction, ₹30 Thousand for repairs) on interest deduction for self-occupied property. This deduction is not available in the New Regime.

- Let-Out Property:

- Input details like “Municipal Value,” “Fair Rent,” “Standard Rent” (if applicable), “Actual Rent per month,” “Municipal Taxes Paid,” and “Interest on Home Loan.”

- Great News: For let-out property, there’s no upper limit on the interest deduction for home loans!

3. Incomes and Deductions

- Total Annual Income (Excluding House Property): Enter your salary, business income, or any other income source here.

- Deductions under Section 80C: This is vital for the Old Tax Regime, allowing deductions up to ₹1.5 Lakhs for investments like PPF, ELSS, life insurance premiums, and home loan principal repayment. This option disappears if you select the New Tax Regime, as Section 80C deductions are not allowed there.

Calculate Your Tax Liability!

Once you’ve filled in all your details, simply click the “Calculate Tax Liability” button!

The calculator provides a detailed and transparent breakdown of your tax situation:

- House Property Income: Shows your Gross Annual Value, Net Annual Value, Standard Deduction (30% of Net Annual Value for Let-Out Property), and interest deduction, leading to your final ‘House Property Income or Loss’.

- Note: For house property loss, you can only set off up to ₹2 Lakhs in a financial year against other income.

- Total Income: Combines your ‘Other Income’ and ‘House Property Income/Loss’ to show ‘Gross Total Income’, then subtracts your Section 80C deduction to arrive at your ‘Net Taxable Income’.

- Tax Liability: This section reveals your ‘Tax on Income’, any ‘Rebate under Section 87A’ (making income up to certain limits tax-free, e.g., ₹5 Lakhs in Old Regime or ₹7 Lakhs/₹12 Lakhs in New Regime depending on FY), ‘Tax after Rebate’, ‘Surcharge’ (if applicable), and ‘Health and Education Cess’. This culminates in your “Total Tax Due”!

Don’t forget to check the ‘Guidance and Information’ section below the results for valuable context and tips specific to your chosen regime and financial year.

Start Planning Your Finances Today!

This tool is fantastic for quickly estimating your tax and making informed decisions, truly helping you plan your finances better!

If you found this guide helpful, please give it a big thumbs up, share it with friends and family who might benefit, and subscribe to the “Tax and GST India” channel for more insightful videos on tax, GST, and financial planning! Your support helps us create more valuable content like this.

Happy calculating, and we’ll see you in the next video!