Navigating the Indian Tax Maze Just Got Easier!

Hello tax enthusiasts and business owners! If you’re running a business or profession in India, you know that understanding your income and expenses for tax purposes can often feel like navigating a complex maze. But what if there was a tool that made it all crystal clear, helping you save time and potentially money?

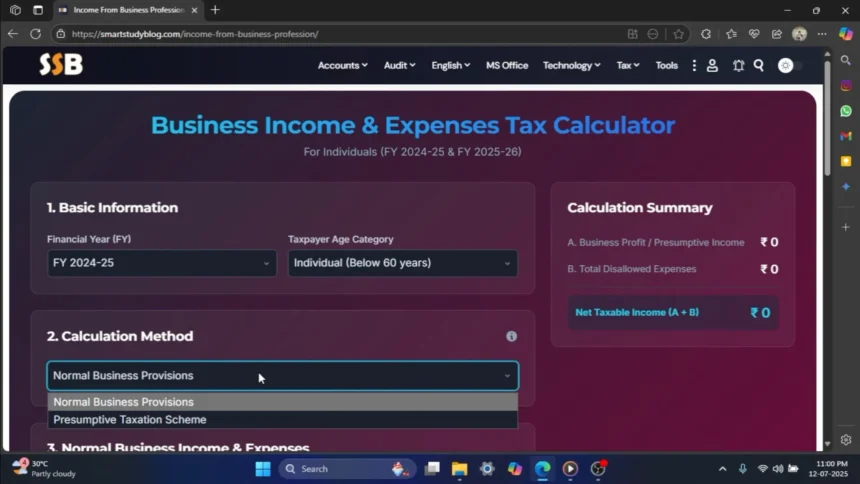

Today, we’re thrilled to introduce you to an incredibly helpful resource: the Business Income & Expenses Tax Calculator for individuals, covering Financial Years 2024-25 and 2025-26! This powerful, user-friendly calculator is designed to simplify your tax planning and ensure you make informed decisions.

What is This Game-Changing Calculator?

This isn’t just another tax tool; it’s a comprehensive solution built to empower individual business owners and professionals. It automatically incorporates the latest tax slabs and rules, including the updated New Tax Regime for FY 2025-26 with a higher rebate limit of up to ₹60,000 for incomes up to ₹12 Lakhs!

Here’s how this calculator becomes your ultimate tax planning partner:

- Effortless Income Calculation: Easily determine your taxable income under both Normal Business Provisions and the Presumptive Taxation Scheme (Sections 44AD, 44ADA, 44AE).

- Demystify Disallowed Expenses: Gain clarity on common disallowed expenses that can impact your tax liability.

- Regime Comparison at a Glance: Instantly compare your tax payable under the Old Tax Regime and the New Tax Regime to choose the most beneficial option.

- Informed Decision Making: Make strategic tax planning choices with clear, concise results.

Understanding Your Calculation Methods

The calculator offers two primary methods for assessing your income, catering to different business and professional needs:

- Normal Business Provisions: If you opt for this, you’ll input your Total Gross Receipts or Turnover and your Total Allowable Business Expenses. The calculator then precisely determines your profit. This mode is particularly useful for businesses with detailed accounting records and allows for the consideration of various disallowed expenses.

- Presumptive Taxation Scheme: Designed to simplify compliance, this scheme assumes income as a percentage of turnover or receipts. It’s ideal for eligible businesses and professionals who prefer a straightforward approach without needing to deduct every single expense.

- Section 44AD for Businesses: Your income is presumed at 6% of turnover received digitally or via banking, and 8% of turnover received in cash.

- Section 44ADA for Professionals: Your income is presumed at 50% of your total gross receipts from the profession.

- Section 44AE for Transporters: Income is calculated at a fixed rate of ₹7,500 per vehicle per month or part of a month, based on the number of goods carriages you own.

Decoding Disallowed Expenses: A Critical Section

One of the most powerful features, especially for those using Normal Business Provisions, is the Comprehensive Disallowed Expenses section. Many expenses, even if paid, might not be fully deductible under income tax law. This tool helps you identify and calculate the impact of these.

Here are some key disallowed expenses the calculator helps you understand:

- Capital Expenses: If incorrectly debited as revenue, 100% is disallowed. These should typically be capitalized and depreciated.

- Cash Payments over ₹10,000 (Sec 40A(3)): Any cash payment exceeding ₹10,000 in a day to a single person (or ₹35,000 for transporters) is 100% disallowed.

- CSR Expenses (Sec 37): Corporate Social Responsibility expenses are fully disallowed.

- Employee PF/ESI not deposited (Sec 36(1)(va)): If employee contributions are collected but not deposited by the due date, 100% is disallowed.

- Excessive Payments to Relatives/Associates (Sec 40A(2)): Payments to specified persons exceeding fair market value will have the excess amount disallowed.

- Expenses without proper bills/documentation (Sec 69C): Unexplained expenditures without satisfactory documentation are 100% disallowed.

- Payments to non-residents without TDS (Sec 40(a)(i)): 100% of such payments are disallowed.

- Payments to residents without TDS (Sec 40(a)(ia)): If TDS was required but not deducted on payments to residents, 30% of that amount will be disallowed.

- Penalties/Bribes/Illegal Payments (Sec 37): Any fines, penalties, or illegal payments are 100% disallowed.

- Personal Expenses: Any personal expenses debited to your P&L account are 100% disallowed.

- Statutory Dues Unpaid (Sec 43B): Dues like GST, PF, ESI, etc., not paid by the ITR filing due date, are 100% disallowed.

As you input these details, the calculator’s summary automatically updates, showing your Business Profit or Presumptive Income, Total Disallowed Expenses, and most importantly, your Net Taxable Income.

Old vs. New Tax Regime: Make the Right Choice!

The calculator’s true magic lies in its ability to calculate your tax under both the Old Tax Regime and the New Tax Regime for the selected financial year. It breaks down the income tax, any rebate under Section 87A, tax after rebate, and the health and education cess, giving you the Total Tax Payable for both regimes. This comprehensive comparison empowers you to choose the regime that’s most beneficial for your financial situation.

How to Access This Powerful Tool!

Accessing this calculator is super easy!

- Go to Google and type “smart study blog” (without any spaces).

- Select the first link: smartstudyblog.com.

- If you are on a mobile device, look for a menu icon with three dashes in the top-left corner, select it, and then choose “Tool” from the menu bar.

- If you are using a desktop, you will find the “Tool” menu directly on the home page.

- Under “Tax and GST India,” you can find this amazing calculator.

Alternatively, you can access it directly here: https://smartstudyblog.com/income-from-business-profession/

Start Planning Your Taxes Effectively Today!

We highly recommend you use this calculator to plan your taxes effectively. It’s a game-changer that can save you time, reduce confusion, and help you optimize your tax liability.

If you found this information helpful, please share this blog post with others who might benefit! Do you have any questions or other tax topics you’d like us to cover? Let us know in the comments below!

Keywords & Hashtags:

- Keywords: income tax calculator, business income tax, income from business and profession, old tax regime, new tax regime, presumptive taxation, section 44AD, section 44ADA, section 44AE, disallowed expenses, income tax india, tax planning, fy 2024-25 tax, fy 2025-26 tax, tax and gst india, how to calculate business income, income tax for professionals, income tax for small business, tax saving tips, tax rules, income tax act, section 87A rebate, health and education cess, total tax payable, smart study blog, tax calculator online, indian tax laws, gst india, income tax updates, financial year 2024-25, financial year 2025-26, tax guide, business profit calculation, taxable income, tax compliance

- Hashtags: #BusinessTaxIndia #IncomeTaxCalculator #FY2024_25Tax #FY2025_26Tax #NewTaxRegime #OldTaxRegime #TaxPlanningIndia #BusinessExpenses #PresumptiveTaxation #Section44AD #Section44ADA #Section44AE #DisallowedExpenses #TaxAndGSTIndia #IndianTaxation #TaxTips #SmallBusinessTax #ProfessionalTax #TaxSavings #ITR #IncomeTaxReturn