Are you a salaried individual in India looking to simplify your tax planning and maximize your savings? Look no further! The HRA Allowance and Tax Calculator is an indispensable online tool designed to help you understand your House Rent Allowance (HRA) exemption and compare your tax liability under both the Old and New Tax Regimes.

Why This Tool is a Game-Changer for Tax Planning

Navigating India’s tax landscape can be complex, but this calculator makes it a breeze. It provides a clear, side-by-side comparison of your tax liability under the Old and New Tax Regimes, enabling you to make informed decisions and choose the most tax-efficient option based on your specific income and rent details.

How to Access the HRA Allowance and Tax Calculator

Accessing this powerful tool is incredibly easy:

- Google Search: Go to Google and type “smart study blog” (without any spaces).

- Select the Link: Click on the first link, which will be smartstudyblog.com.

- Navigate to the Tool:

- Mobile Users: Look for a menu icon with three dashes in the top-left corner, select it, and then choose “Tool” from the menu bar.

- Desktop Users: You’ll find the “Tool” menu directly on the home page.

- Find the Calculator: Under “Tax and GST India,” select “HRA Calculator”.

Link to Tool: https://smartstudyblog.com/hra-tax-calculator/

YouTube Guide: https://www.youtube.com/watch?v=TSfsnIxupy8

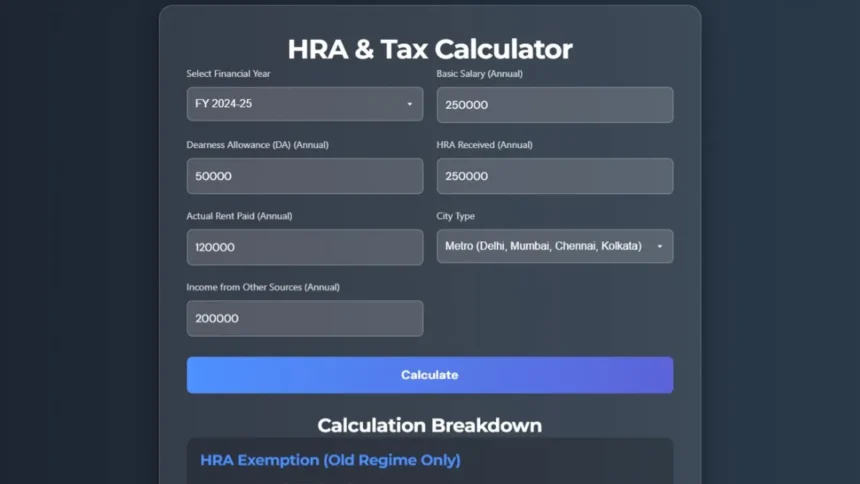

A Step-by-Step Guide to Using the Calculator

The calculator boasts a clean and intuitive interface, making it simple to calculate your HRA exemption and overall tax. Let’s walk through how to use it.

- Select Financial Year: It’s crucial to select the correct financial year (FY), as tax rules and slabs can change. Currently, you can choose between FY 2024-25 and FY 2025-26.

- Enter Annual Basic Salary: Input your annual basic salary. For example, if your monthly basic is ₹50,000, your annual basic would be ₹600,000.

- Input Annual Dearness Allowance (DA): If you receive DA, enter the annual amount. If not, you can simply enter zero.

- Enter Annual HRA Received: Input the total HRA you’ve received annually from your employer.

- Enter Actual Annual Rent Paid: This is crucial, as HRA exemption is tied to the rent you actually pay.

- Select Your City Type:

- Metro: Choose ‘Metro’ if you live in Delhi, Mumbai, Chennai, or Kolkata. These cities have a higher HRA exemption limit of fifty percent of your basic salary plus DA.

- Non-Metro: For all other cities, select ‘Non-Metro’, where the limit is forty percent.

- Enter Income from Other Sources: Include any other taxable annual income not part of your salary, such as interest income, rental income from other properties, or any other taxable income.

- Click ‘Calculate’: Once all the details are filled in, simply click the ‘Calculate’ button.

Understanding Your Results: HRA Exemption and Tax Regimes

Upon clicking ‘Calculate’, the tool instantly displays a detailed breakdown of your HRA exemption and your tax liability under both tax regimes.

HRA Exemption Breakdown

The calculator clearly shows your Exempted HRA and Taxable HRA. It also provides a transparent breakdown of how the exemption is calculated, comparing three conditions:

- Actual HRA received.

- Fifty percent or forty percent of your salary depending on your city.

- Rent Paid minus ten percent of your salary.

The least of these three amounts is your exempted HRA.

Old Tax Regime vs. New Tax Regime

The side-by-side comparison is incredibly valuable for quick decision-making.

- Old Tax Regime: You’ll see your Gross Total Income, your Net Taxable Income, and the final Income Tax payable. The breakdown further clarifies how your Net Taxable Income is arrived at, by deducting HRA exemption and the standard deduction. It also shows the tax calculation based on the old regime slabs, including any rebate under Section 87A, and the four percent cess.

- New Tax Regime: Similarly, for the New Tax Regime, you’ll see the Gross Total Income, Net Taxable Income, and the Income Tax. Remember, under the new regime, you generally don’t get most exemptions like HRA, but it offers lower tax slab rates and a standard deduction. The breakdown here shows how the standard deduction is applied and the tax calculated as per the new regime’s slabs, along with the Section 87A rebate and cess.

Maximize Your Savings Today!

Using the HRA Allowance and Tax Calculator simplifies a complex process, helping you maximize your HRA benefits and ensuring you’re choosing the most tax-efficient regime based on your specific income and rent details.

Try out this calculator today and take control of your tax planning!