Are you an Indian taxpayer feeling overwhelmed by the complexities of capital gains calculations? Do you struggle to accurately determine your tax liability on various assets, from stocks and mutual funds to property and even emerging virtual digital assets?

If so, you’re in the right place! Welcome back to Tax and GST India, your trusted resource for simplifying Indian taxation.

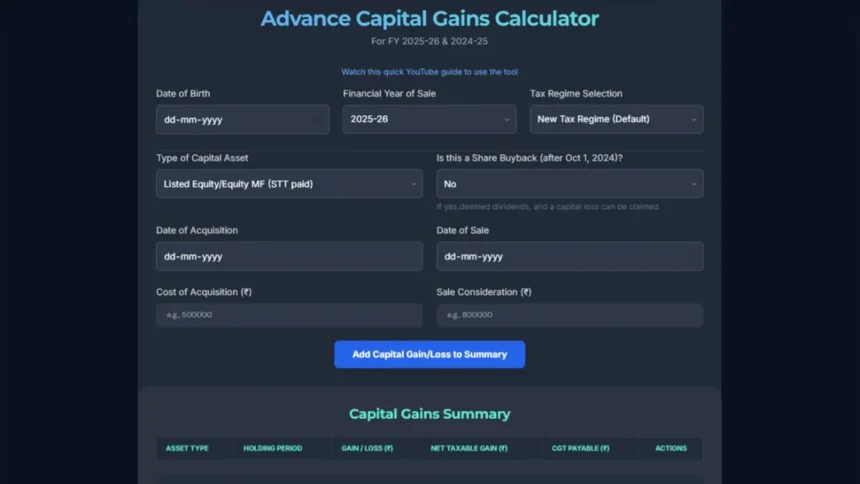

Today, we’re thrilled to unveil a game-changer: the Advance Capital Gains Calculator. This isn’t just another online tool; it’s a meticulously designed, comprehensive solution built specifically for Indian capital gains. It empowers you to understand and calculate your tax obligations with unprecedented ease and accuracy.

What Makes Our Advance Capital Gains Calculator Different?

Our calculator is engineered to handle the nuances of Indian tax laws, incorporating the latest updates up to Financial Year 2025-26. This includes crucial provisions that can significantly impact your tax planning. Say goodbye to guesswork and complex spreadsheets – our tool does the heavy lifting for you!

Key Features You’ll Love:

- Comprehensive Asset Coverage: Calculate gains for a wide range of assets, including:

- Equity (Listed & Unlisted)

- Mutual Funds

- Immovable Property

- Debt Instruments

- Gold (Physical & Digital)

- Bonds

- And even Virtual Digital Assets (VDAs)!

- Dynamic Tax Regime Selection: Compare tax liabilities under the Old vs. New Tax Regime to optimize your tax strategy.

- Age-Based Slab Rates: Automatically accounts for your age (General, Senior, or Super Senior Citizen) to apply correct slab rates under the Old Tax Regime.

- Automatic Indexation: For long-term capital gains, the calculator intelligently applies the Cost Inflation Index (CII) from 2001-02 up to projected figures for 2025-26, minimizing your taxable gain.

- Smart Holding Period Analysis: Automatically determines if your gain is Short-Term Capital Gain (STCG) or Long-Term Capital Gain (LTCG) based on asset type and applies the correct rules.

- Share Buyback Handling: Specifically addresses share buyback scenarios for listed equity, treating proceeds as deemed dividends and cost as a capital loss.

- Loss Set-Off & Carry Forward: Intelligently sets off capital losses against gains and clearly displays unutilized losses eligible for carry forward.

- FY 2025-26 Special Rule: Incorporates the crucial one-time rule allowing Long-Term Capital Loss to be set off against Short-Term Capital Gain for FY 2025-26.

- Section 87A Rebate: Automatically applies the Section 87A rebate if your income qualifies, helping you maximize tax savings.

- Detailed Tax Breakdown: Get a clear, segmented view of your tax calculation, distinguishing between fixed-rate gains and slab-rate taxed gains combined with other income.

- Understand Loss Set-Off & Carry Forward: See clearly how losses are adjusted and what unutilized losses you can carry forward, including the special FY 2025-26 rule for LTCG vs. STCG set-off. Virtual Digital Asset losses are correctly shown as non-set-off/carry-forward as per current laws.

- Important Notes: Below the summary, find vital reminders about tax laws, especially the FY 2025-26 special rule.

How to Access Your New Best Friend for Tax Planning:

Getting started is simple! Access the Advance Capital Gains Calculator directly here: https://smartstudyblog.com/indian-capital-gains-calculator/

- On Mobile: Look for the menu icon (three dashes) in the top-left corner, tap it, and then select “Tool” from the menu bar. Under “Tax and GST India,” choose “Capital Gains Tax India.”

- On Desktop: You’ll find the “Tool” menu directly on the homepage. Under “Tax and GST India,” select “Capital Gains Tax India.”

The Advance Capital Gains Calculator will then open, ready for you to use!

A Quick Tour: How to Use the Calculator

The tool is incredibly intuitive, designed for ease of use.

- Enter Your Date of Birth: This is crucial for age-based slab rate calculations under the Old Tax Regime.

- Choose Your Financial Year of Sale: Plan for current or future tax years with flexible FY selection.

- Select Your Preferred Tax Regime: See how your liability changes between the Old and New Regimes.

- Important Note: Once you add your first gain/loss, these three inputs (DOB, FY, Tax Regime) will lock to ensure consistency for all transactions in that calculation.

- Add Asset Details:

- Asset Type: Select from the dropdown. The calculator dynamically adjusts calculations (STCG/LTCG, holding periods) based on your choice. Notice the ‘Is this a Share Buyback?’ option appears only for ‘Listed Equity’ – that’s smart!

- Date of Acquisition & Cost of Acquisition: For long-term gains, indexation is automatic, using CII data from 2001-02 up to projected 2025-26. Assets acquired before April 1, 2001, correctly use the 2001-02 base year index.

- Date of Sale & Sale Consideration: Enter these precise details.

- Hit ‘Add Capital Gain/Loss to Summary’: Your transaction will appear in the summary table, providing an instant overview. You can add multiple transactions this way.

- Don’t Forget ‘Other Income’: Crucial for accurate slab rate calculations, this input is conveniently located in the summary section.

- Review Your ‘Total Estimated Tax Payable’ & ‘Tax Calculation Breakdown’: This is where the magic unfolds! Get a detailed, transparent view of your tax liability, how fixed-rate and slab-rate gains are treated, and how your ‘Other Income’ interacts with your capital gains.

Empower Your Tax Planning Today!

While our Advance Capital Gains Calculator is an incredibly powerful tool, remember that tax laws are complex and personal financial situations vary. It’s always advisable to consult a qualified tax professional for personalized advice.

This calculator empowers you to make informed financial decisions and plan your taxes with confidence. No more guesswork, no more frustrating spreadsheets!

Found this helpful? Give us a thumbs up, share this post with anyone who could benefit, and subscribe to Tax & GST India for more invaluable financial tools and insights. Don’t forget to hit that notification bell so you don’t miss our next video, like this one: Capital Gains Tax Calculator FY -25 & FY-26 | STCG & LTCG Simplified! (New Tax Laws Included)!

What other financial calculators or tax topics would you like us to cover? Let us know in the comments below!