Are you looking to get a clear picture of your income tax liability for the financial year? It can often feel complicated with all the different income sources, deductions, and tax regimes. But what if you had a tool that simplifies it all?

Today, we’re going to walk you through a comprehensive and easy-to-use Indian Income Tax Calculator from “Tax and GST India”. By the end of this guide, you’ll be able to confidently use it to get a detailed and accurate estimate of your tax liability.

Let’s get started!

How to Access the Calculator

To access this powerful tool, simply go to Google and type “smart study blog” (without any spaces). Select the first link, which will be smartstudyblog.com.

- On Mobile: Look for a menu icon with three dashes in the top-left corner, select it, and then choose “Tool” from the menu bar.

- On Desktop: You’ll find the “Tool” menu directly on the home page.

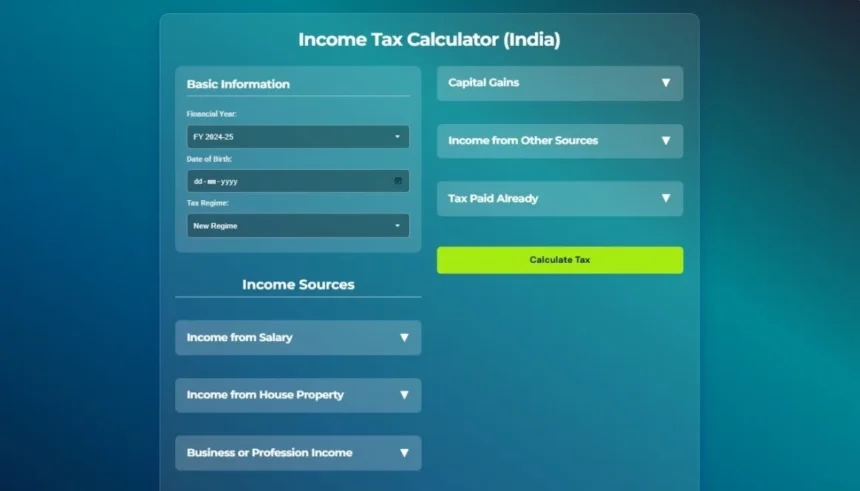

Under “Tax and GST India”, select “Income Tax Calculator (India)”. The income tax calculator will then open.

Step-by-Step Guide to Using the Calculator

1. Basic Information

First things first, let’s fill out the Basic Information section.

- Financial Year: The first dropdown lets you select the financial year for which you want to calculate your taxes. Options for both Financial Year 2024-25 and the upcoming Financial Year 2025-26 are available. Select the one that applies to you.

- Date of Birth: Next, enter your date of birth. This is crucial, especially if you’re opting for the Old Tax Regime, as tax slabs differ for senior and super senior citizens.

- Tax Regime: This is a crucial choice. You can select between the New Regime and the Old Regime. Your choice here determines which deductions you can claim. When you select ‘Old Regime’, the ‘Deductions’ section becomes available; it disappears with the ‘New Regime’ as most deductions are only available under the old regime.

2. Income Details

Now, let’s move on to your income. The calculator breaks this down into different sources for ease of use.

Income from Salary

- Just type in your Basic Salary and Dearness Allowance.

- House Rent Allowance (HRA): Enter the total House Rent Allowance you’ve received from your employer. If you live in a rented house, enter the Actual Rent Paid. Also, specify whether you live in a Metro City (like Delhi, Mumbai, Chennai, or Kolkata) or a Non-Metro City. The calculator will automatically figure out the House Rent Allowance exemption for you under the Old Regime.

- You can also add your Leave Travel Allowance, Conveyance Allowance, Special Allowance, and any Other Allowances you might have.

- As you enter these numbers, the Total Gross Salary at the bottom updates automatically. The calculator also applies the standard deduction of 50,000 where applicable. It’s that simple!

Income from House Property

- If you have a property that you’ve rented out, enter the Gross Annual Value here. This is the rent you’ve received after deducting municipal taxes. The calculator will automatically apply the standard 30% deduction.

- If you have a home loan for a self-occupied property, you can enter the Interest on Home Loan here. You can claim a deduction of up to 2 lakhs.

Business or Profession Income

For those who are self-employed or run a business, we have the Business or Profession Income section.

- You can declare your income under the Presumptive Scheme if you’re eligible. Options include Section 44AD for small businesses, 44ADA for professionals, and 44AE for transporters.

- If you select a presumptive scheme, a new field for Gross Turnover or Receipts will appear. Just enter your turnover, and the calculator will compute your presumptive income for you.

- If you don’t fall under the presumptive scheme, you can directly enter your Other Business Income.

Capital Gains

This section is designed to handle the recent changes in tax laws.

- First, enter the Date of Capital Gain Transfer. This is very important as the tax rates change for transfers made on or after July 23, 2024.

- Then, you can enter different types of capital gains:

- Short-Term Capital Gains under Section 111A from listed equity shares.

- Normal Short-Term Capital Gains from assets like debt funds or property.

- Long-Term Capital Gains under Section 112A from listed equity shares.

- Long-Term Capital Gains at 20% which is typically for property where you claim indexation benefits.

- And finally, any Other Capital Gains from unlisted shares or other assets.

Income from Other Sources

This is for any income that doesn’t fit into the above categories.

- You can enter your Dividend Income, which is taxed at your slab rate.

- Enter the Interest from your Savings Account. The calculator will automatically apply the deduction under section 80TTA or 80TTB.

- If you’ve received Gifts from non-relatives exceeding 50,000, you can enter that here.

- And finally, there’s a field for Other Miscellaneous Income, which could be interest from fixed deposits or any other income.

3. Deductions (Old Tax Regime Only)

If you’ve selected the Old Tax Regime, this section is for you. Here you can claim your Deductions to lower your taxable income.

- Enter your investments under Section 80C, which includes things like Provident Fund, PPF, and life insurance premiums, up to a maximum of 1.5 lakhs.

- You can also claim a deduction for Medical Insurance premiums under Section 80D.

- There is also a field for Other Deductions to include things like donations, interest on education loans, and more.

4. Tax Paid Already

We’re almost there! In the Tax Paid Already section, you can enter any tax you’ve already paid for the financial year.

- This includes TDS (Tax Deducted at Source) that your employer or clients may have deducted.

- And any Advance Tax that you have paid.

Getting Your Results

Once you’ve filled in all your details, click the big green ‘Calculate Tax’ button.

And there you have it! A detailed Tax Calculation Summary. Let’s quickly go through the results.

The results will include:

- It starts with a Gross Income Breakdown, showing you where all your income is coming from.

- Then you get a detailed breakdown of your Salary Income, including any House Rent allowance exemption that has been applied.

- It shows your Total Taxable Income after all the deductions.

- You’ll see a clear breakdown of how the tax on your normal income is calculated based on the tax slabs.

- It also shows the tax calculated on your different types of capital gains.

- The summary accounts for any Tax Rebate you might be eligible for and adds the Surcharge and Cess.

- Finally, at the very bottom, you get the most important number: the Net Tax Payable or, if you’ve paid extra, the Net Tax Refundable. It even deducts the TDS and Advance Tax you’ve already paid.

Conclusion

And that’s it! In just a few minutes, you can get a comprehensive and easy-to-understand summary of your tax liability. This tool is perfect for tax planning and getting a clear financial picture.

Please remember: This calculator is for estimation purposes. It’s always a good idea to consult with a tax professional for personalized advice.

Thank you for Reading! I hope you find this calculator as helpful as I do. If you have any questions, feel free to leave them in the comments below.

Happy tax planning!