ITR – Medicare levy -ATO

Medicare levyM1 - Medicare levy reduction or exemptionMedicare Means:Australia's public health system known as MedicareLevy MeansCollect or Demand Money…

ITR – Losses – ATO

LossesL1 - Tax losses of earlier income yearsIf you have tax losses from an earlier income year that you have…

ITR – Deduction Notes -ATO FY 2021 -2022

Deduction Notes: FY 2021 -2022D1 - Work-Related Car ExpensesWork-related car expenses are expenses you incurred as an employee for a…

ITR – Income Notes – ATO

Income Notes: 1. Salary or wages 2. Allowances, Earnings, Tips, Directors’ fees etc 3. Employer lump sum payments 4. Employment…

Individual Tax Return – ATO

Individual Income Heads IndexIncome DeductionLossesOffsetsMedicareIncome TestSpouseBusinessEstimatesScheduleWorksheet Individual Tax ReturnLabelsIncome 1Salary or wages 2Allowances, Earnings, Tips, Directors’ fees etc 3Employer lump sum payments 4Employment termination payments 5Australian…

Tax Rates – ATO

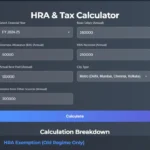

Individual Tax RateResident Tax Rate FY 22-23 Individual Marginal Rate0-18200Nil18201-4500019%45001-12000032.5%120001-18000037%Above 18000045%Note: The above rates don't include the Medicare levy of 2% Resident Tax…

Introduction to IAS – ATO

Introduction to IASInstalment Activity Statement (IAS)IAS is a Form Lodge by Tax Payers who are not required to register GSTIAS…

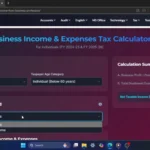

Introduction to BAS

Introduction to BASBusiness Activity Statement (BAS)If a Business Entity is Registered for GST, then you need to lodge BASBAS…

Introduction to GST – ATO

Introduction to GSTWhat Is GSTMost Goods or Service Sold or Consumed in Australia are Subject to 10% Goods and Service…

ATO Acronymous

AcronymousMeaningPAYGPay As You GoFBTFringe Benefit TaxBASBusiness Activity StatementGSTGood and Service TaxIASInstallment Activity StatementICAIntegrated Client AccountASActivity StatementTRTTrust Tax ReturnTINTax File…