Hello and welcome to Tax and GST India, your trusted resource for simplifying the complexities of taxation!

As a salaried individual in India, the annual question of choosing between the old and new tax regimes can be a daunting task. With different slab rates and deduction rules, it’s easy to get confused about which option will leave you with more money in your pocket. But what if there was a tool that could eliminate the guesswork entirely?

We’ve got your back. In this guide, we’ll introduce you to a fantastic, free tool: the Salary Income Tax Calculator. By the end of this post, you’ll be able to confidently calculate and compare your tax liabilities under both regimes for the financial years 2024-25 and the upcoming 2025-26 in just a few simple steps.

Let’s dive in and take control of your financial planning!

How to Access the Free Income Tax Calculator

Getting to the calculator is quick and easy.

Alternatively, you can find it by going to Google and searching for “smart study blog,” then navigating to the “Tool” section on the website.

A Step-by-Step Guide to Using the Calculator

Once you’ve opened the tool, you’ll find a clean, intuitive interface. We’ll walk you through each section to ensure you get the most accurate results.

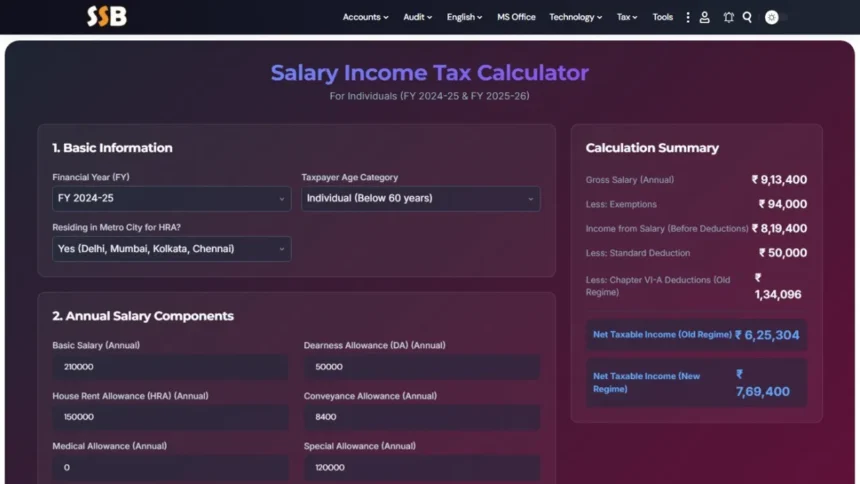

Section 1: Your Basic Information

This first section sets the stage for the calculation.

- Financial Year: Choose between FY 2024-25 and FY 2025-26. This is perfect for advance planning!

- Taxpayer Age Category: Select whether you are below 60, a Senior Citizen (60-80), or a Super Senior Citizen (above 80). Tax slabs vary by age, so this is a crucial step.

- Metro City Resident: Indicate if you live in a metro city like Delhi, Mumbai, Kolkata, or Chennai. This is essential for calculating your House Rent Allowance (HRA) exemption accurately.

Section 2: Your Annual Salary Components

Next, it’s time to input your earnings. Remember to enter the annual amounts for each component.

- Basic Salary: The core of your salary.

- Dearness Allowance (DA): If applicable.

- House Rent Allowance (HRA): The full HRA amount you receive.

- Allowances: Enter your Conveyance, Medical, and Special Allowances.

- Bonus, Incentive, Commission: Include any variable pay you’ve received.

- Other Taxable Allowances: A field for any other taxable benefits.

As you fill this in, you’ll see your Gross Annual Salary instantly calculated in the summary box on the right.

Section 3: Deductions & Exemptions (The Key to Tax Savings!)

This is where you can significantly reduce your taxable income, primarily under the Old Tax Regime.

- Rent Paid for HRA: Enter your total annual rent. The calculator will automatically compute your HRA exemption based on this.

- Section 80C Investments: Input your annual contributions to your Employee’s EPF, PPF, Life Insurance Premiums, home loan principal, and ELSS mutual funds.

- Other Key Deductions: The tool includes separate fields for:

- Section 80D: Medical insurance premiums.

- Section 80CCD(1B): Additional NPS contributions (up to ₹50,000).

- Donations (80G): Any charitable contributions.

- Interest on Home Loan & Education Loan.

Watch the Calculation Summary on the right update in real-time as you enter your investments. This is where the magic happens, showing you a live comparison of your taxable income under both regimes.

Section 4: Tax Deducted at Source (TDS)

In this final input section, simply enter the total income tax your employer has already deducted from your salary throughout the year.

The Grand Finale: Your Personalized Tax Comparison

Once all your information is entered, scroll down to the Tax Calculation Details. Here, the calculator provides a clear, side-by-side comparison of the Old and New Tax Regimes, breaking down:

- Taxable Income

- Calculated Income Tax

- Applicable Rebate

- Tax After Rebate

- Health and Education Cess

- Total Tax Payable

Finally, it subtracts your TDS to show you the Net Tax Payable or, if you’re lucky, your Tax Refund!

This powerful, instant analysis removes all doubt. You can now clearly see which regime is more beneficial for your specific financial situation.

Plan Ahead for FY 2025-26 Today!

At Tax and GST India, we believe that understanding your taxes should be straightforward. This tool is designed to empower you to make informed decisions and plan for the year ahead with confidence.

Found this guide helpful?

- Try the Calculator: Salary Income Tax Calculator FY 2025-26

- Watch the Tutorial: For a visual walkthrough, check out our YouTube video: Old vs New Tax Regime: Which is Better? | Salary Income Tax Calculator FY – 2025 & FY – 2026

- Subscribe for More: For more easy-to-understand videos on tax and GST, subscribe to our channel, Tax and GST India, and hit the bell icon to never miss an update.

If you have any questions, please leave them in the comments below. We’re here to help!